71 Erstaunlich Auslagenerstattung Vorlage Word Galerie

Ziemlich Excel Reise Reiseplan Vorlage Bilder Ideen der , Kredit : krynicazdroj.info {% endif % Ziemlich Excel Reise Reiseplan Vorlage Bilder Ideen Danke an krynicazdroj.info 71 Erstaunlich Auslagenerstattung Vorlage Word Galerie eigenbeleg vorlage zum kostenlosen download eigenbeleg vorlage richtig ausfüllen...

43 Fabelhaft Ertragsvorschau Vorlage Kostenlos Foto

Beliebte Downloads • Bürovorlagen Kostenlos Dokumente Abschnitt , Achtung : downloads.ch {% endif % Beliebte Downloads • Bürovorlagen Kostenlos Dokumente Kredit downloads.ch 43 Fabelhaft Ertragsvorschau Vorlage Kostenlos Foto kostenlose downloads businessplan die zum kostenlosen download angebotenen dateien vorlagen muster und...

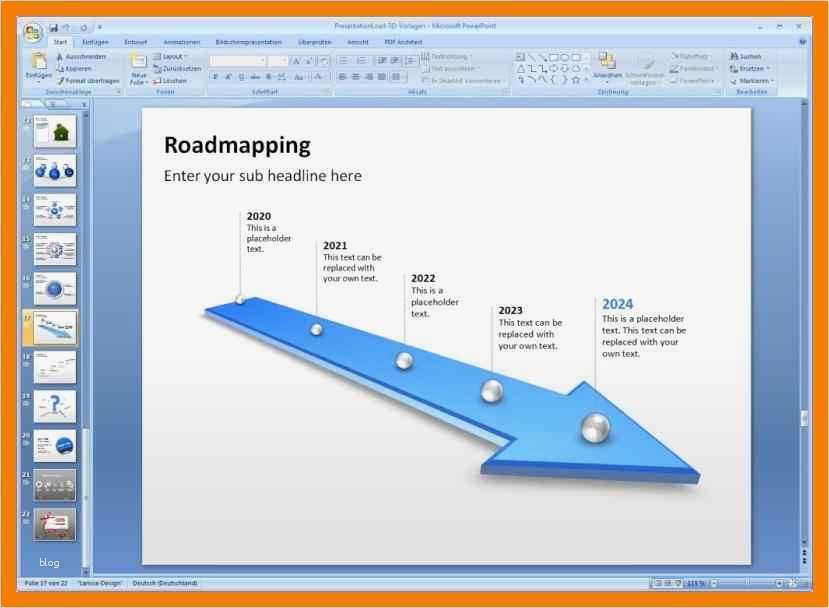

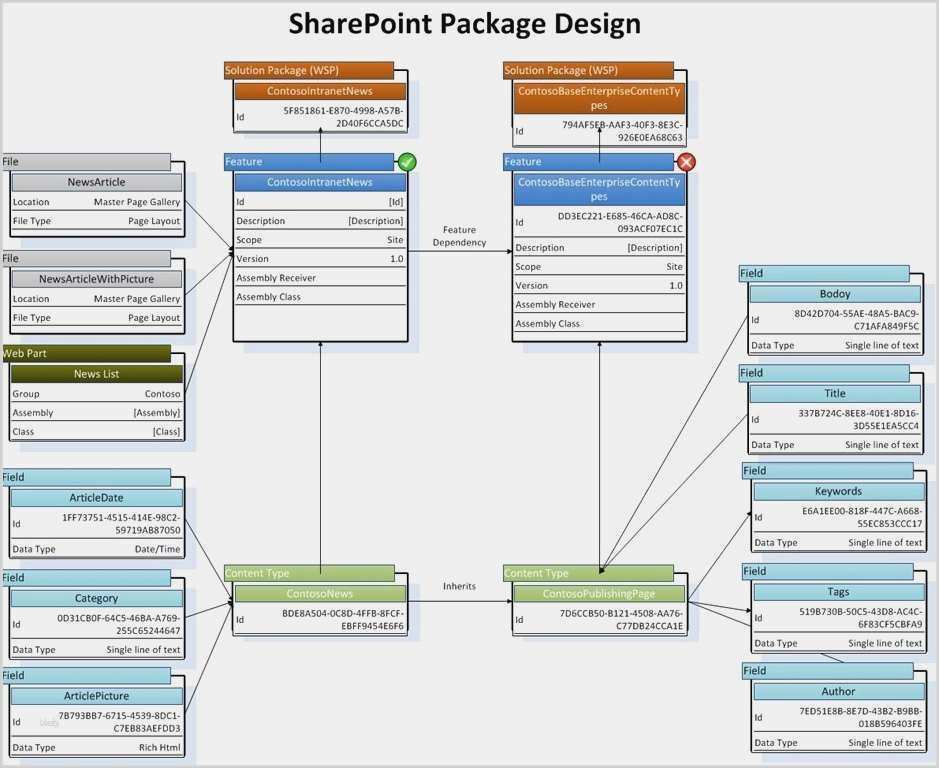

55 Erstaunlich Zeitleiste Powerpoint Vorlage Bilder

Ungewöhnlich Kostenlose Zeitleiste Vorlage Powerpoint der , Bild-Gutschrift : foiling.info {% endif % Ungewöhnlich Kostenlose Zeitleiste Vorlage Powerpoint Kredit foiling.info 55 Erstaunlich Zeitleiste Powerpoint Vorlage Bilder freie zeitleiste vorlagen für profis officetimeline freie zeitleiste vorlagen für profis diese kostenlose zeitleistenvorlage...

32 Inspiration Kündigung Depot Vorlage Ideen

Depot Kündigung der , Kredit : www.brokervergleich.net {% endif % Depot Kündigung Vielen Dank an www.brokervergleich.net 32 Inspiration Kündigung Depot Vorlage Ideen depot kündigen mit unserer vorlage in 2 minuten zur depot kündigen 11 18 reibungslos aktiendepot kündigung mit vorlage...

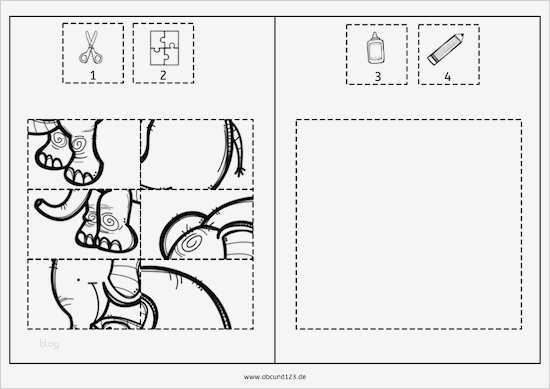

58 Angenehm Vorlagen Zum Ausschneiden üben Bilder

Fensterbilder für den Herbst basteln 25 Ideen und Vorlagen Abschnitt , Achtung : deavita.com {% endif % Fensterbilder für den Herbst basteln 25 Ideen und Vorlagen Vielen Dank an deavita.com 58 Angenehm Vorlagen Zum Ausschneiden üben Bilder schneiden lernen mit...

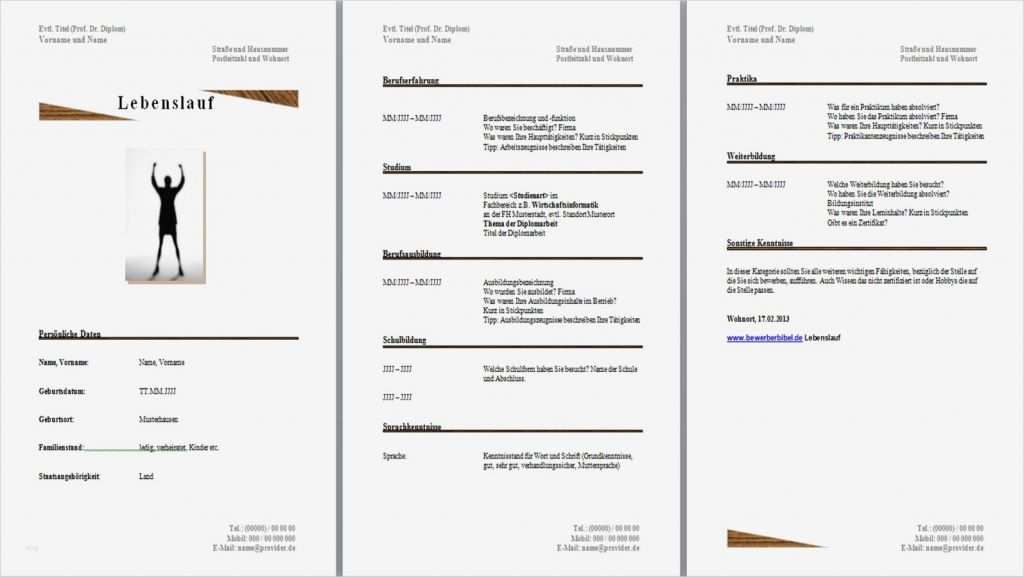

34 Neu Praktikumsplatz Bewerbung Vorlage Bilder

8 bewerbungsanschreiben praktikum Stück , Quelle : theradishsociety.com {% endif % 8 bewerbungsanschreiben praktikum Danke an theradishsociety.com 34 Neu Praktikumsplatz Bewerbung Vorlage Bilder vorlage bewerbungsschreiben um einen praktikumsplatz bewerbung um einen praktikumsplatz sehr geehrter herr dissen herzlichen dank für unser...

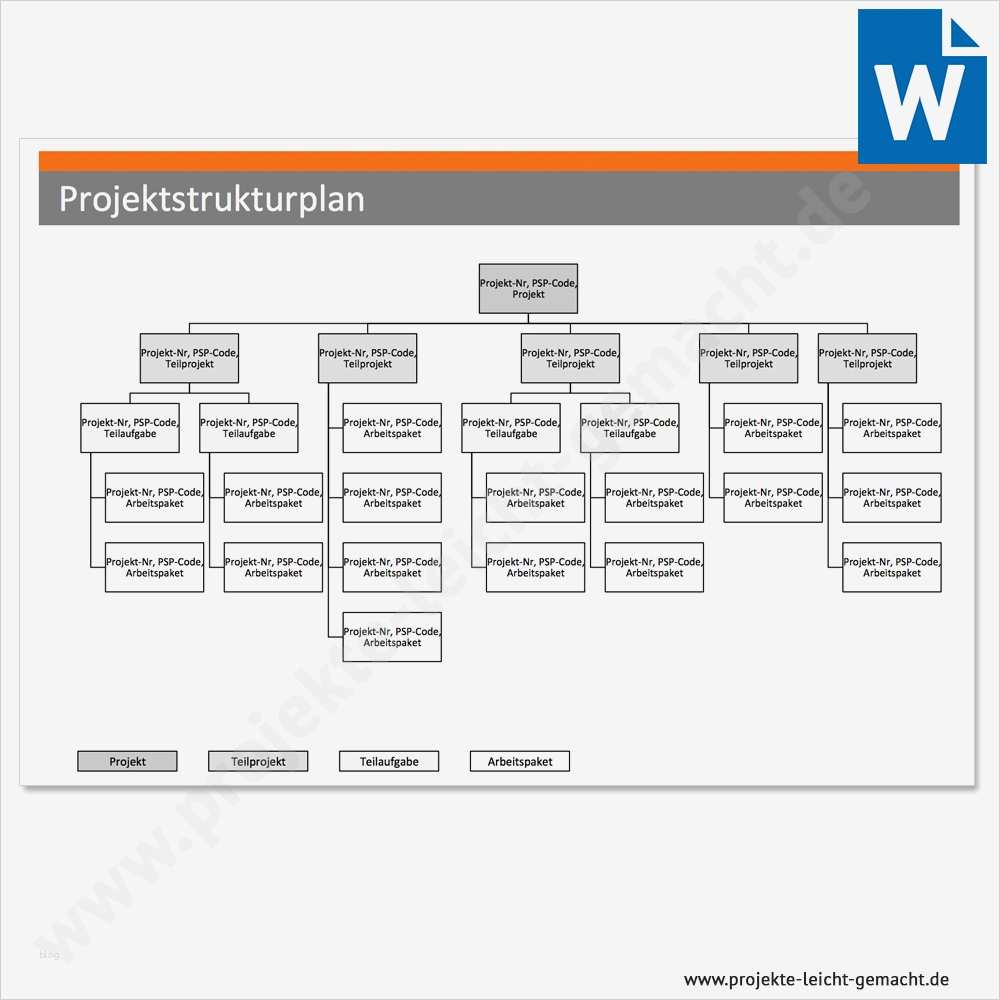

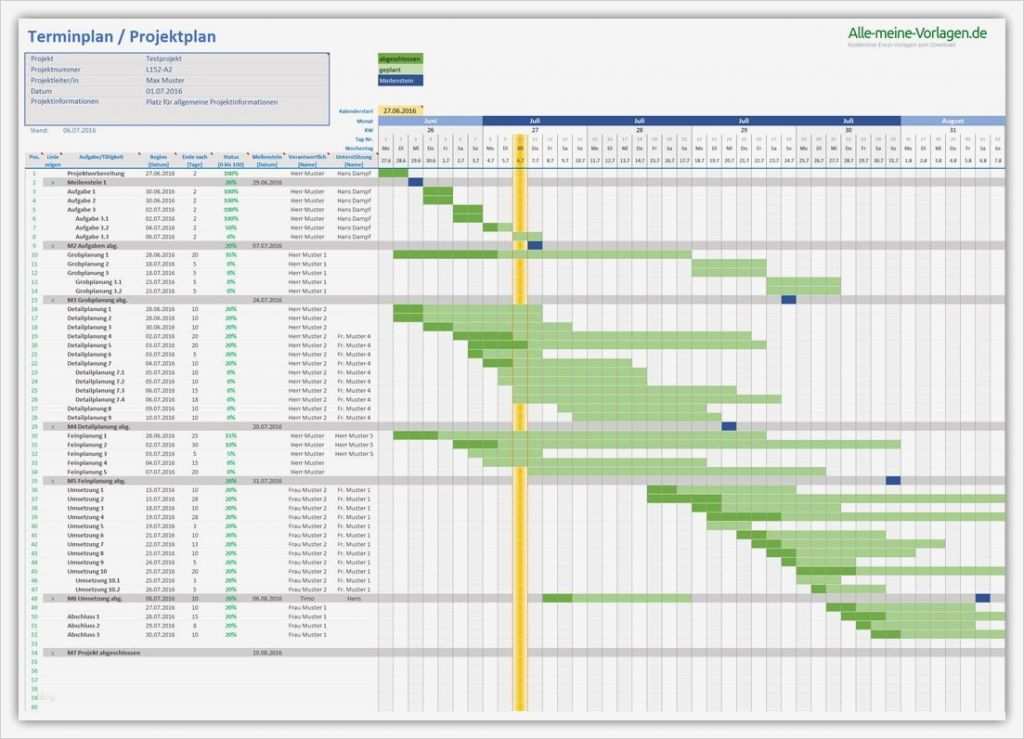

59 Cool Terminplan Excel Vorlage Vorräte

Kulturmanagement Blog Kostenlose Vorlage für einen Stück , Bild-Gutschrift : kulturmanagement.wordpress.com {% endif % Kulturmanagement Blog Kostenlose Vorlage für einen Bild Kredit kulturmanagement.wordpress.com 59 Cool Terminplan Excel Vorlage Vorräte projektplan excel selber ein projektplan excel vorlage bzw zeitplan zu erstellen...

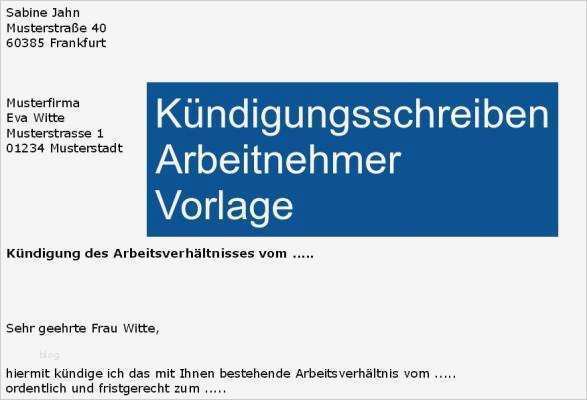

36 Genial Kündigung Durch Arbeitnehmer Vorlage Bilder

Kündigungsschreiben Arbeitnehmer der , Bild-Gutschrift : meine-kuendigung.de {% endif % Kündigungsschreiben Arbeitnehmer Vielen Dank an meine-kuendigung.de 36 Genial Kündigung Durch Arbeitnehmer Vorlage Bilder kündigungsschreiben muster form inhalt 4 vorlagen fristlose kündigung durch den arbeitnehmer die oben genannten beispiele beziehen sich...

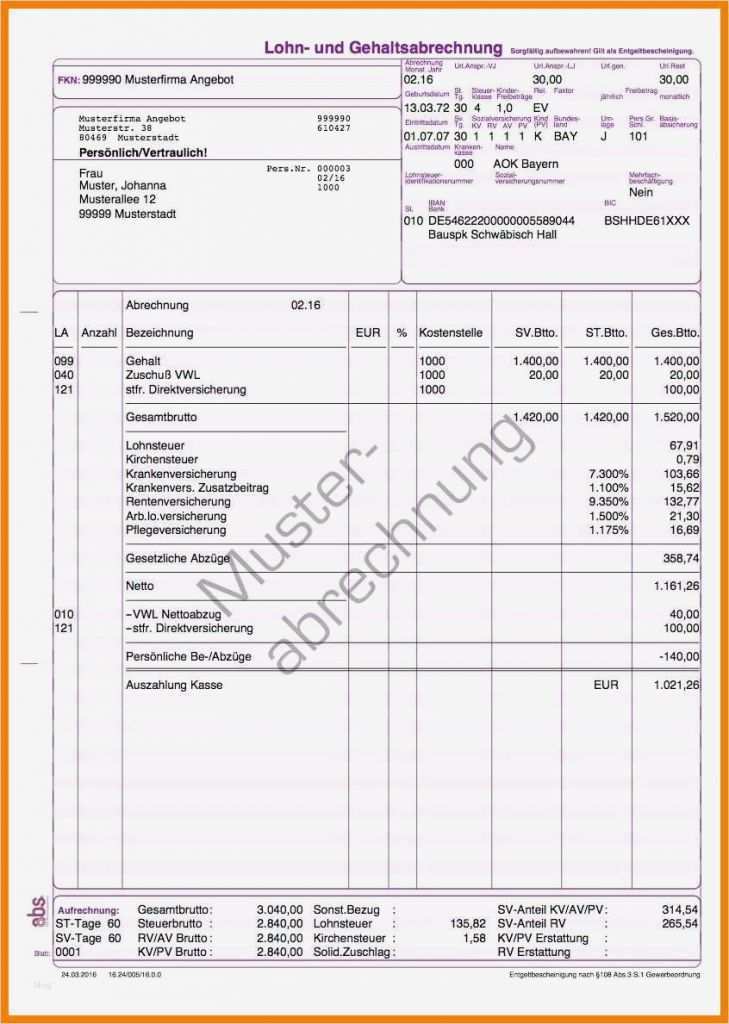

51 Luxus Lohnabrechnung Vorlage Gratis Bilder

Gratis Lohnabrechnung Vorlagen Abschnitt , Quelle : www.convictorius.de {% endif % Gratis Lohnabrechnung Vorlagen Kredit www.convictorius.de 51 Luxus Lohnabrechnung Vorlage Gratis Bilder lohnabrechnung vorlage gratis herunterladen professionelle vorlage für lohnabrechnung kostenloser download jetzt herunterladen lohn und gehaltsabrechnung – kostenlos zum...

55 Fabelhaft Website Layout Vorlagen Modelle

Flash Vorlage für Web Design Stück , Kredit : www.templatemonster.com {% endif % Flash Vorlage für Web Design Respekt für www.templatemonster.com 55 Fabelhaft Website Layout Vorlagen Modelle homepage vorlagen eigene website erstellen basteln sie eine schöne website mit ser einladenden...

![Lieferantenerklärung 2017 Vorlage Hübsch Sanktionslisten Prüfung Line [kostenlose Anleitung]](https://www.ccgps.org/wp-content/uploads/2018/10/lieferantenerklarung-2017-vorlage-hubsch-sanktionslisten-prufung-line-kostenlose-anleitung-der-lieferantenerklarung-2017-vorlage-150x150.png)